Careshield Life Opt Out - Why Careshield Life Is Good For You With 0 Monthly Payout

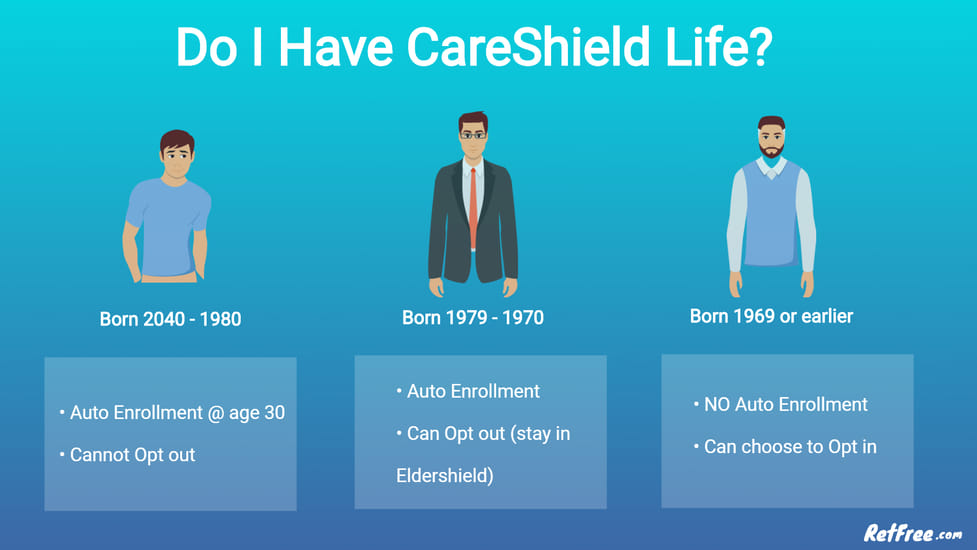

Subsequent cohorts will join the scheme upon turning 30. CareShield Life is a national disability insurance scheme that will replace the ElderShield scheme.

Careshield Life The Complete Guide In 2021

Frequently Asked Questions about CareShield Life.

Careshield life opt out. CareShield Life will be universal and mandatory for Singaporeans PRs aged 30 to 40 from 1st Oct 2020. You can opt out of CareShield Life by 31 Dec 2023 if you do not wish to join the scheme and you will automatically be placed back onto ESH400 scheme. Please note that only Singapore Citizens and Permanent Residents born between 1980 to 1990 aged 30 to 40 in 2020 with a CareShield Life policy are currently eligible to apply.

However you can opt out by 31st Dec 2023 if you do not wish to remain on CareShield Life. You will need to top up your premiums to switch to CareShield Life. To aid in this transition the premiums of CareShield Life will be subsidised for the first five years between the years of 2020 to 2024.

However unlike ElderShield which can be opted out of CareShield Life is made compulsory for all Singaporeans born in 1980 or later. Residents born earlier than 1970. What is CareShield Life.

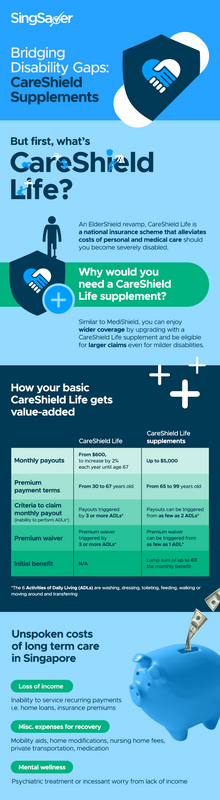

With an enhanced CareShield Life plan the lifetime payout benefit can be increased up to 5000 per month. ElderShield was introduced in 2002 as a basic long-term care insurance scheme targeted at severe disability especially during old age. But specifically for those born between 1970 to 1979 youll be automatically enrolled into CareShield Life when end-2021 comes and have the option to opt out from it by 31 Dec 2023 with full refunds.

It pays a monthly amount for life and it is meant to pay for part of the cost needed for long term care LTC. You can opt to manually join CareShield Life from mid-2021 if youre not currently severely disabled. CareShield Life is a national insurance scheme launched on 1st October 2020 for Singaporeans and PRs born in the year 1980 and.

All Singaporeans born in 1979 or earlier and who join CareShield Life will pay a base premium. Is it true that one cannot opt out of CareShield Life. For those born in 1979 or earlier CareShield Life is not compulsory and is on an opt-in basis.

The Government is giving up to 2500 over 10 years to encourage older people to join CareShield Life. The starting monthly cash payout will be 600 in 2020. Jumat 15 Oktober 2021.

Base premiums are paid from the age you join until age 67 inclusive of the year you turn age 67 or for a period of 10 years for those who join CareShield Life at age 59 or older in end-2021. Can I opt out of CareShield Life. You will be automatically enrolled into CareShield Life from end-2021.

The scheme currently provides cash payouts of 300 or 400 per month for up to 5 or 6 years. What Exactly Does It Cover. It supports you at old age by providing a stream of income upon severe disability.

CareShield Life is a national insurance scheme for Singaporeans and PRs born in 1980 and later. If you are under Eldershield Life and want to opt in for CareShield Life. Supplement premiums can be paid using MediSave up to a limit of 600 per calendar year per person insured.

You can choose to join CareShield Life from end-2021 onwards if you are currently not. Base premiums will increase over time. CareShield Life is a long term care and disability insurance scheme for Singaporeans and Permanent Residents.

More information to be announced later Born in 1979 or earlier without existing ElderShield. Examples for Opting In to Careshield Life While on ElderShield. Yes but only from 2021.

To claim from CareShield youll need to satisfy the definition of a severe disability. CareShield Life is a long-term care insurance scheme that provides basic financial support should Singaporeans become severely disabled especially during old age and need personal and medical care for a prolonged duration ie. Enrolment into CareShield Life will begin from end.

CareShield Life is mandatory for individuals born after 1980 to ensure that all Singaporeans have basic protection for long-term care needs. This will allows you to structure. Merdeka and Pioneer generations will get an additional 1500 premium subsidy making it a total of 4000 over 10 years.

Unlike the existing Eldershield scheme which is issued by private insurers CareShield Life is administered directly by the Ministry of Health Singapore. With CareShield Life offering universal coverage this means that you would be able to join CareShield Life now even if you have previously opted out of ElderShield or were above the maximum entry age for ElderShield in 2002. The Government is introducing CareShield Life a national long-term care insurance scheme designed to provide basic protection against long-term care costs from 2020.

Unlike Medishield Life which is compulsory for all ElderShield is an opt-out scheme. Assuming you didnt opt out and you entered at the age of 40 the premiums for. Lifetime cash payout as long as remained severely disabled.

To ensure CareShield Life premiums stay affordable and payouts which start from S600 and increases with time last a lifetime everyone has. Should you opt in to CareShield Life. Why do we need CareShield Life.

This is provided that you are not severely disabled at time of entry. That means all Singaporeans and Permanent Residents PRs can choose to opt-out of the insurance scheme if they wish to. But specifically for those born between 1970 to 1979 youll be automatically enrolled into CareShield Life when end-2021 comes and have the option to opt out from it by 31 Dec 2023 with full refunds.

If you have to manually opt into CareShield Life or have a chance to opt out you might be wondering if paying CareShield Life premiums is worth it. CareShield Life on the other hand covers severe disability which is defined as when one cannot perform 3 out of 6 of the activities of daily living ADLs.

Careshield Life All You Need To Know About This Long Term Care Insurance Scheme

Careshield Life Bill Passed In Parliament What You Need To Know About The New Scheme Health News Top Stories The Straits Times

Complete Guide To Buying A Careshield Life Supplement Plan

Careshield Life All You Need To Know Homage

Best Careshield Life Supplement Plans In Singapore Singsaver

Careshield Life A New Beginning

Why Careshield Life Is Good For You With 0 Monthly Payout

Careshield Life Supplement Best Upgrade Option Comparison Moneyline Sg

The New Careshield Life Sg One Step Health Insurance Facebook

Cpf News Medisave Care And Careshield Life Launch End 2020 Turtle Investor

Everything About Careshield Life And Careshield Life Supplements Interestguru Sg

Guide To Careshield Life Should I Buy Supplementary Insurance

How Does Careshield Life Affect Me Should I Switch To Careshield Life Or Stay Put With Eldershield Karen Tang Cfp Certified Financial Planner In Singapore

Careshield Life All You Need To Know Homage

Careshield Life Ultimate Guide For Singaporeans Prs

Eldershield To Be Renamed Careshield Life With Higher Lifetime Payouts From 2020 Today

Post a Comment

Post a Comment